PayPal is one of the most popular payment management apps out there. If you’ve engaged in ecommerce in any way, whether that be as a freelancer, a business, or even a customer, you’ve probably encountered PayPal in some way, shape, or form. Fun fact: one of PayPal’s founders is Elon Musk, whose name you’ve almost certainly heard in connection with one of his other ventures like Tesla or Twitter. However, his app isn’t the only payment management protocol in the world. Here are our top 10 PayPal alternatives to try out!

Stripe

Unfortunately, you can only take advantage of Stripe if you’re in North America, so you won’t be able to use it if you’re a European customer. However, Stripe is competitive with PayPal, charging a 2.9% commission on payments. Unlike PayPal, it doesn’t conduct business through a third-party site; instead, it simply facilitates payment directly from the provider’s platform, so there’s no need to redirect customers. Stripe is well-liked and trusted by many businesses, and it’s used by the likes of Amazon and Lyft.

Venmo

Again, Venmo isn’t supported outside the US right now, but it’s quickly becoming the payment app of choice for many people who just want to swap small amounts between themselves. You might hear people saying “Venmo me for this” or “I’ll Venmo you”, and that’s usually a good indication that an app is taking off. This app is built around smaller transactions, and it has social media features like comments and likes built into it, so it’s intended for a younger audience, too.

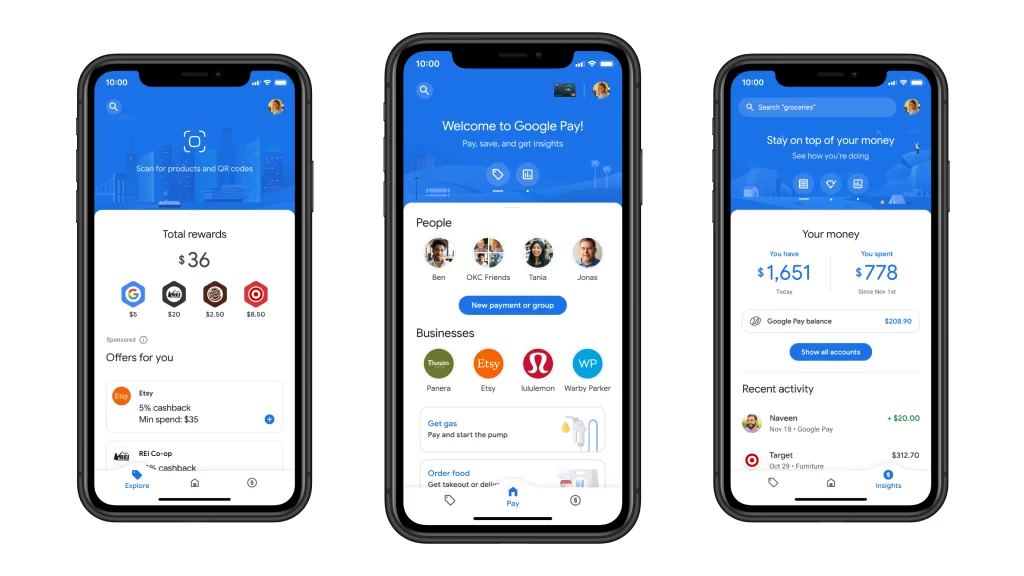

Google Pay

There’s a theme emerging here, isn’t there? Google Pay killed off peer-to-peer payments in the UK back in September 2019, but if you’re in the US, you can still use it to send money to your friends, PayPal-style. Just like PayPal, Google will let you transfer money, but it doesn’t impose any transactional fees, so you’re better off using it if you don’t want to send any money Google’s way. You can even use it on your iPhone if you want to, although Apple Pay may be a better alternative if you have an iPhone.

Skrill

Hooray! Finally, an app available outside the US. Despite its somewhat unpleasant name, Skrill is a great PayPal alternative that will let you send and receive money quickly and easily. You don’t need to share bank details with other Skrill users, so it’s secure, too. If you’re interested in cryptocurrency, Skrill also provides the opportunity to buy and sell it, so it’s an all-purpose app that’s useful for more than just paying your friends back for yesterday’s Uber.

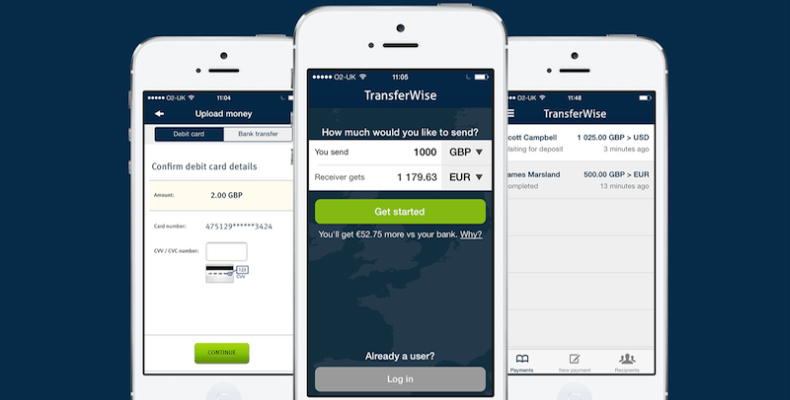

Wise

You might know Wise as TransferWise, which is what it was called before it changed its name in February 2021. If you do a lot of international business, then Wise should be one of your first ports of call; it’s got solid exchange rates, as well as providing a multi-currency account that lets you manage your money across a range of different currencies. To put it simply, if your business is international, then you’re probably going to use Wise at some point.

Payoneer

Payoneer is perfect for smaller businesses looking to get paid quickly and securely. It’s more geared towards business customers than individuals, but if you’re a freelancer or a small business and you want to set up a payment protocol, Payoneer should suffice. It won’t need you to code at all, unlike Stripe, and it’s got a simple pricing structure, too. Payment between Payoneer customers doesn’t cost you anything, but it will likely cost you to transfer funds to your bank account.

Square

Is your business primarily built around in-person point-of-sale transactions? If so, then you need Square on your side. Technically, it does also have online capabilities, but it’s best when used with the physical payment machine it sends you when you sign up for an account. You can create invoices, utilise powerful payroll management systems, and more with Square, and although it charges you for transactions, the fee of just under 3% isn’t too bad.

Amazon Pay

With the weight of a massive corporation like Amazon behind it, Amazon Pay is being accepted and utilised in more and more places around the world, so you may well see it pop up sooner rather than later. As you might expect, it’s a button that allows you to instantly pay for products or services using your Amazon account and payment details. It’s quick and easy for both customers and ecommerce services, and since customers need an Amazon account, it’s safe as well.

Apple Pay

Earlier, we said that if you’re using an iPhone or iOS device, you’re probably going to want to use Apple Pay. Well, its time has come. Apple Pay is, effectively, Google Pay for iPhones. You can use it to pay businesses with just a single tap of your device, and if you’re a business, you can incorporate an Apple Pay button that lets customers use their Apple account to pay for goods or services. You can also use Apple Pay to send and receive money, so it’s a strong PayPal alternative.

Zelle

Sadly, Zelle is another app that can only be used in the US right now. However, if you are US-based and you want an app that’s easy to use, Zelle is the one for you. It interfaces with a large number of different bank accounts, so you can send and receive money directly through your bank. This is ideal for sending money to anyone who doesn’t have Zelle themselves; you can use the app, but they don’t need to if they don’t want to. Zelle is a great PayPal alternative due to its simplicity.