One of the most important things you need to do as a business owner is to invoice your customers. It’s not fun and nobody really enjoys doing it; requesting money from clients is a difficult enough process, but chasing that money up can be a real headache. That’s why it’s a good idea to seek out an invoicing app that can take care of all the difficult parts for you. Luckily, there are plenty of those apps out there, so without further ado, let’s take a look at the best invoicing apps for small businesses.

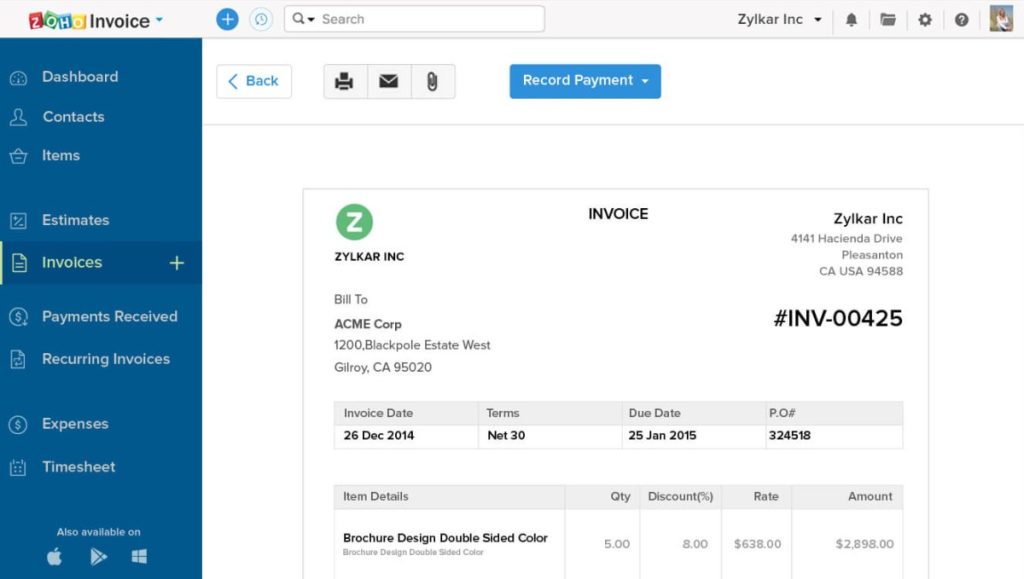

1. Zoho

Zoho bills itself as being specifically geared towards small businesses, and that’s how it feels. It’s entirely free, so you and your business won’t have to pay anything for invoicing customers, which can feel great when every penny already seems to be allocated elsewhere. Zoho is slick, easy to use, and feature-rich; although it won’t necessarily compete with some of its bigger brothers, it’s excellent if your business is just getting started and has a smaller customer base.

2. QuickBooks

QuickBooks isn’t just an invoicing app; it’s a fully-featured accounting platform that will help you and your business monitor your finances. Obviously, it does include invoicing capabilities, but you’ll also find ways to track and manage your expenses and income, as well as payroll functionality and tax allocation. Whether you’re a sole trader or a business looking to boost your finances, you could definitely do a lot worse than QuickBooks, although there’s no free tier available, unfortunately.

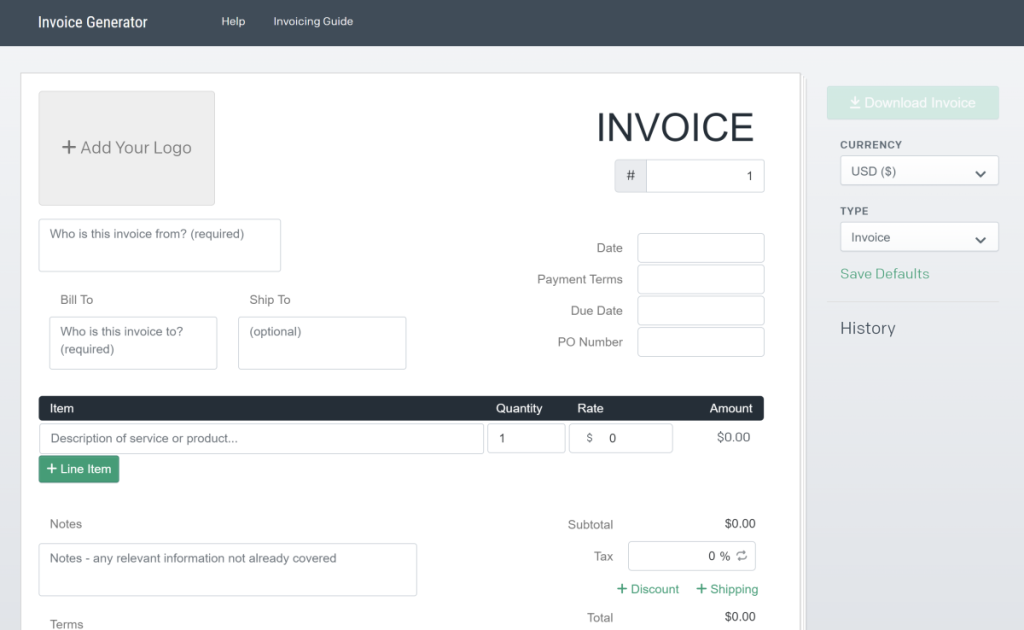

3. Invoiced

Do you want a free, no-frills invoice generator that literally just helps you to set up an invoice, no questions asked? Invoice Generator by Invoiced is the one you want to go for. It simply allows you to input your own data, including the invoice’s recipient, the items you’re billing the client for, and any terms and conditions you need to add. That’s it – there’s no extra functionality, no resource-hogging software, and no extra bells or whistles to worry about.

4. Invoicely

You might remember Invoicely as Invoiceable, but it’s since changed its branding and become more competitive when it comes to offering invoice services to businesses. The free tier will get you five invoices per month and three saved clients, making it ideal for sole traders who don’t have diverse sources of income. Upgrading to the basic plan, which costs just $10 a month, gets you 100 invoices and 25 saved clients, and there are additional tiers available that scale even further.

5. KashFlow

If you’re based in the UK, then KashFlow is the perfect financial software for you. It can help you to go through the UK’s new (but no less labyrinthine) tax process, and it also integrates directly with the UK’s HMRC organisation, so you can make submitting taxes much easier. Of course, KashFlow also has invoicing capabilities built into it, as well as a range of other financial features, so if you’re UK-based and looking for a reliable financial companion, KashFlow is that companion.

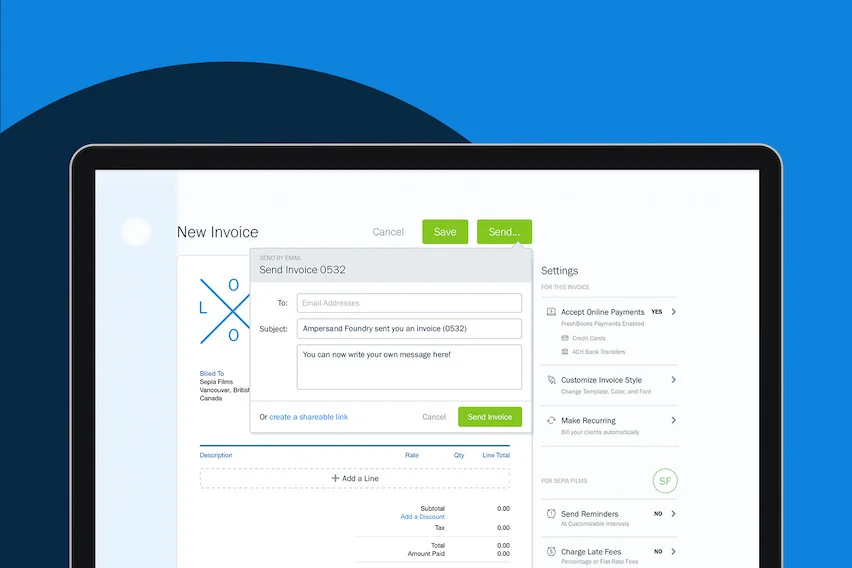

6. FreshBooks

FreshBooks is another solid option for smaller businesses and individual freelancers looking for great invoicing software. The invoices it generates look professional and sleek, so you won’t have to worry about looking amateurish when you submit your expenses. The app also offers time tracking features, so that you can work out how much every member of a small team is owed for their services, and much more besides. Pricing is competitive, too, although there’s no free tier.

7. Xero

Again, Xero is good for UK customers, because it allows you to submit taxes to HMRC directly. It also offers the chance to send quotes to clients, as well as up to 20 invoices, on its basic plan, which costs £14 per month. Xero isn’t really worth considering until you’ve built up a solid client base; there are other options that will do what Xero does for less money. Still, the feature list is great, so Xero is worth looking into once your business has been built up a little.

8. FreeAgent

Like many of the other options on this list, FreeAgent offers comprehensive, simple-to-use accounting software for smaller businesses. If you’ve got a business current account with various UK banks including NatWest or Royal Bank of Scotland, you could potentially nab yourself a FreeAgent subscription for, well, free, so make sure to look into that if you like the look of the software. Beginners should apply here first, as there are a range of great invoice templates to help your expenses look professional.

9. Moon Invoice

Moon Invoice offers an entirely free invoicing tool, and it has a range of other features available for both free and paying customers, including estimate creators, purchase order generators, and more. Naturally, as you pay more for your subscription, the amount of invoices and expense documents you can generate increases, so if you have a high volume of business coming in every month, then you’re going to want to pay for at least Moon Invoice’s Silver tier.

10. Harvest

Harvest is, principally speaking, a time tracking app, but it also has invoicing tools built in, so we’re including it in this list. It’s a nice, simple-looking program that lets you track time across your organisation with just one click. Other features include reminders to help you start and finish tracking time, as well as online payments that sync with other invoicing tools like QuickBooks and Xero. Harvest also syncs with productivity suites like Asana and Trello, so it’s a great additional tool for a startup.